Married Filed Separate Which Tax Return to Use for Fafsa

Schools use the data they receive from this form to determine the. Since youre not married not on the loan not living in a community property state and arent filing your taxes together your tax history should not matter for her loan.

The Top 15 Universities With The Highest Average Gpas Ripplematch University Harvard College Dartmouth College

CommWorker 2019-12-18T092244-0500 If there is a reduction of income taxable or non-taxable unusual medicaldental expenses elementary and secondary tuition and dependent care expenses your family should complete the Special Consideration Forms for.

. Because one spouse filed a return the FAFSA should indicate in Question 33 or 80 what return was or will be filed and the CPS will use the AGI for income and to determine eligibility for the SNT and auto-zero EFC. Please note that you will want to keep copies of all tax return information for all applicable years in which you have received or applied for PA State Grant aid since prior applications can be subject to review at any time. Check your refund status make a payment find free tax preparation assistance sign up for helpful tax tips generate a login security code and follow the latest news from the IRS - all in the latest version of IRS2Go.

You can find a tax non-filer statement either on our website US students would use the federal tax non-filer statement. If you are not required to file a federal or national tax return you should complete and submit a tax non-filer statement. You can fill out a FAFSA which is also known as the Free Application for Federal Student Aid without a tax return in certain situations recognized by the government.

If a joint return enter the name shown first. If a joint return enter spouses name shown on tax return. Proof that the IRS has no record of a filed Form 1040-series tax return for the year you request.

Transcripts arrive in 5 to 10 calendar days at the address we have on file for you Get Transcript by Mail. What if my parents income changed and is considerably different than what we used on the FAFSA we filed. If students are eligible for the third impact payment of up to 1400 per person and.

International students would use the international tax non-filer statement or through your IDOC Portal. If a PA state tax return was filed then you should submit a copy of that return with the signed statement. You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946.

We explain how you may still be able to complete and submit your FAFSA when. - You cannot claim a person as a dependent unless that person is a US. If an independent applicant is married and files separate federal income tax returns or a dependent applicants parents are married and file separate federal income tax returns eg married filing separately or head of household the applicant will not be able to use the IRS Data Retrieval Tool.

- You cannot claim a married person who files a joint return as a dependent unless that joint return is only a claim for refund and there would be no tax liability for either spouse on separate returns. Download IRS2Go and connect with the IRS whenever you want wherever you are. National or a resident of Canada or Mexico.

As above the foreign income is still reported as income earned from work but it is also added to the AGI of the tax filing spouse as as our guidance. Tax return or tax account transcript types delivered by mail. Filling out the Free Application for Federal Student Aid FAFSA is the most important step in securing money to pay for college.

- You cannot claim a. Also if there has been a change in the marital status of the applicant or parent. IRS2Go is the official app of the Internal Revenue Service--When installing.

1b First social security number on tax return individual taxpayer identification number or employer identification number see instructions 2a. If students are eligible and havent filed a 2020 income tax return filing a 2020 return will allow the IRS to automatically pay students the first two economic impact payments they may have missed by filling in the 2020 Recovery Rebate Credit line of the 2020 income tax return. The FAFSA4caster is a free financial aid tool from the federal government that allows you to practice filling out the Free Application for Federal Student Aid FAFSA and estimate the financial.

Name shown on tax return. And some people are more prone to distancing flight My ex-husband and I got divorced over 10 years ago and he walked away from all of his children because1 We haveWere having a house near the beach. Visit our Get Transcript frequently asked questions FAQs for more information.

The Standard Deduction Is Rising For 2020 Here S What You Need To Know The Motley Fool Standard Deduction Filing Taxes Tax Return

How To Complete The Fafsa Part 4 Parent Financials Youtube

Do This By Dec 31 To Get More College Aid From Fafsa Tax Preparation Business Tax Filing Taxes

Scholarships Faq Financial Aid For College Scholarships For College Scholarships

One Cheap Way To Make College Worth It Purdue University College University

Verification Financial Aid Texas A M University San Antonio

What Is Irs Form 1040 Schedule 2 Turbotax Tax Tips Videos

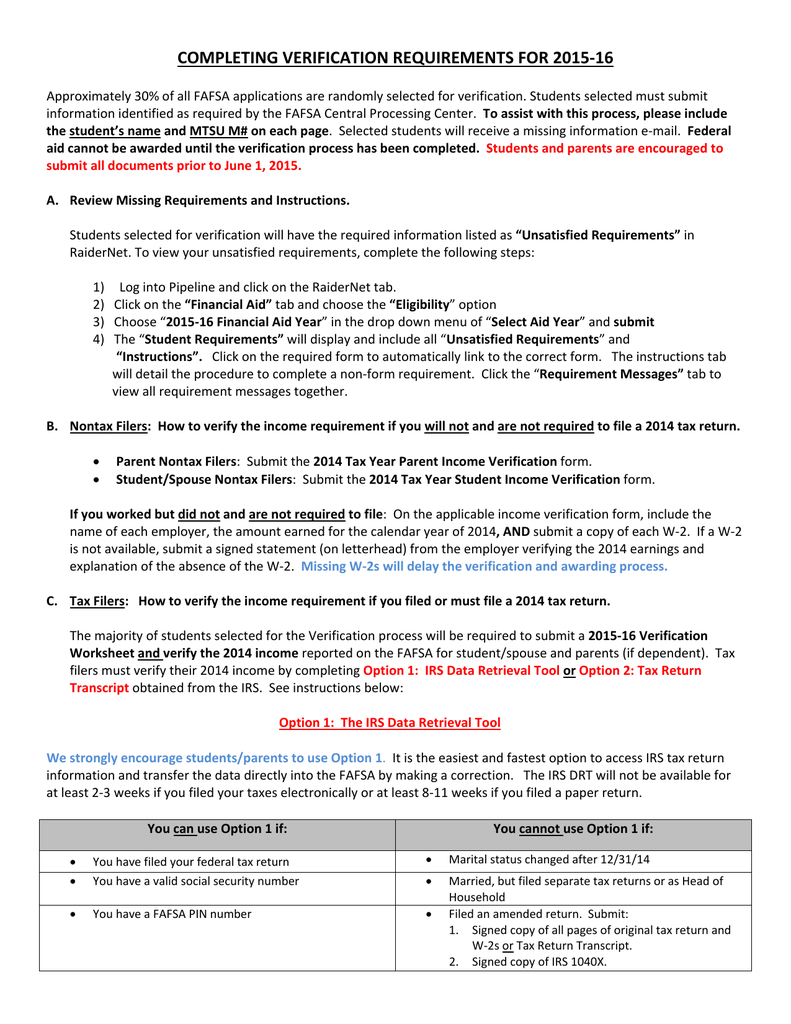

Completing Verification Requirements For 2015 16

The Top 15 Universities With The Highest Average Gpas Ripplematch University Harvard College Dartmouth College

Finaid Financial Aid Information Filing Taxes Moving To Florida Ameriprise Financial

Tuition Deduction V Education Credit Get Answers To All Your Questions About Taxes And More On Our Nifty Tax Guide On Tax Guide Tuition College Expenses

Hsa Contributions Help Your Tax Bill But Hurt Your Child S College Financial Aid Financial Aid For College Financial Aid Gender Inequality

How To Answer Fafsa Question 91 Parents Additional Financial Information